The container shipping industry is preparing for renewed chaos, disruption, congestion, and backlogs as Shanghai restarts its manufacturing and supply chain operations after two months of strict lockdown. A recent survey by Container xChange suggests that this year’s summer peak season cargo surge will be even more chaotic for global supply chains than the 2021 peak shipping season. Keep reading this post where we have elaborated on the Container xChange survey and enumerated the numerous challenges lying ahead for the ocean freight industry in the next two quarters of 2022.

Tough times ahead for the container shipping industry

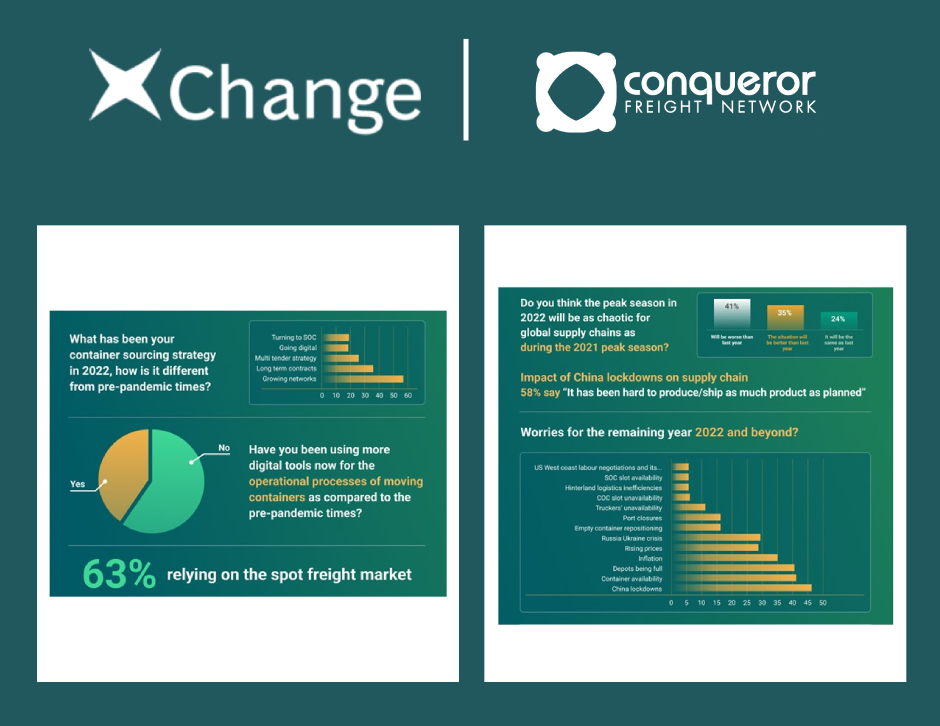

The survey by Container xChange, (a marketplace and technology infrastructure provider for container logistics companies) titled xChange Industry Pulse Survey found that 51% of respondents expect the 2022 iteration of the peak season to be “worse” than last year. Around 26% predicted this year’s peak season would be less chaotic than in 2021, while 22% expect the level of “chaos” to be the same.

The shipping operations in Shanghai have restarted at a time when the sea freight sector is traditionally moving towards the peak season. Therefore, we can see a sharp rise in vessel diversions since mid-April that is happening because of the backlog in export cargo. Additionally, the third quarter of every year is generally a very busy time for the container shipping sector. This is because at this time the retailers start building inventories for the end-of-season sale in the UK, US, and beyond. The high volume of shipments in 2021 caused record shipping freight rates, delays, and congestion. Moreover, it also negatively impacted the reliability of container shipping services.

Join Us Now & enjoy 10% discount

on Xchange Container suscription

The container sourcing strategy of sea freight forwarders

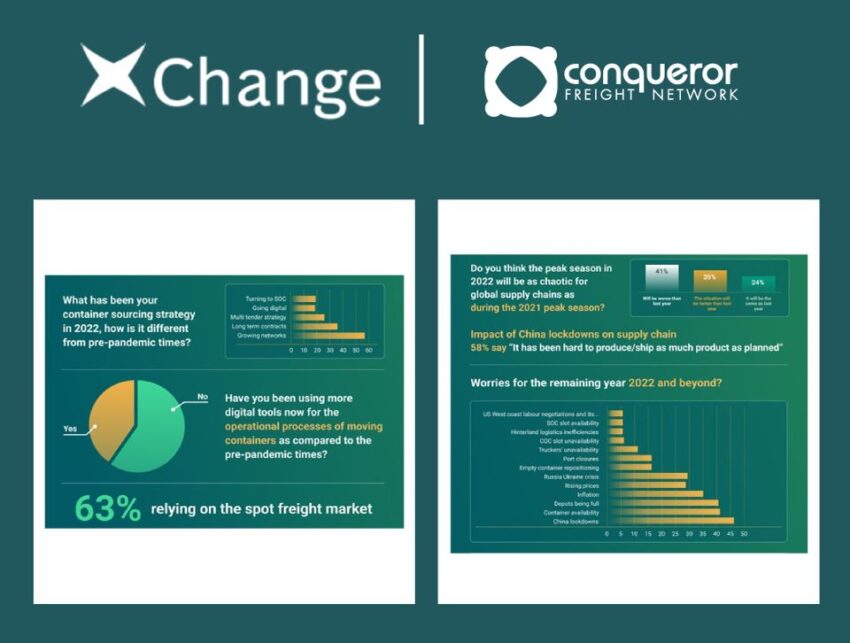

Let us now take a look at what the Container xChange survey respondents had to say about their container sourcing strategy.

In terms of container sourcing strategy, in 2022, when compared to pre-pandemic times, 56% of respondents said they had been “growing networks”, 38% said they had agreed to “long-term contracts” and 25% said they had followed a “multi-tender strategy”. Additionally, 37.5% of respondents said they were ensuring clients received enough inventory by “shipping early” in 2022, 25% were “using alternative shipment routes” and 18.8% were contracting long-term slot agreements with carriers. Surprisingly, 62.5% said they were still relying on the spot market or doing nothing specific to ensure shipments reach clients.

Impact of the Shanghai lockdown on global trade

The lockdowns in Shanghai for 8 weeks have considerably destabilized the supply chain industry. A whopping 58% of respondents of the survey have reported that the lockdowns not only slowed down the shipping process but even decreased the volume of production. The obvious consequence was shipment backlogs and unsatisfied demand because of China’s limited exports to the EU and the US. To quote Christian Roeloffs, the Co-Founder of Container xChange, “Predicting exactly what will happen in this year’s peak season is harder than normal because there are so many contradictory signs and intangibles.”

Mr. Roeloffs further explains that the Covid 19 lockdowns have impacted the availability of cargo for exporting to the markets in Europe and North America. Therefore, when China does away with its stringent Covid policy we will see a considerable surge as the export backlogs will resume shipping. However, when the lockdown rules are completely relaxed and the truckers resume working, those backlogs will arrive at the same time as the peak season cargo. As a result, there could be congestion and blockage at the ports in the US and EU. It has to be remembered that the ports in Europe and North America are already battling with rising congestion.

The problem with the container shipping demand

It’s time to take a quick look at how the issues in the container shipping industry are affecting the demand. As per the survey by Container xChange, multiple metrics indicate that demand is possibly ebbing. Therefore, the deflating demand might help to counterbalance an unexpected rush of shipments from China. Lastly, other challenges in the container shipping sectors apart from the lockdowns in China include container availability, rising fuel costs, inflation, and the war in Ukraine.