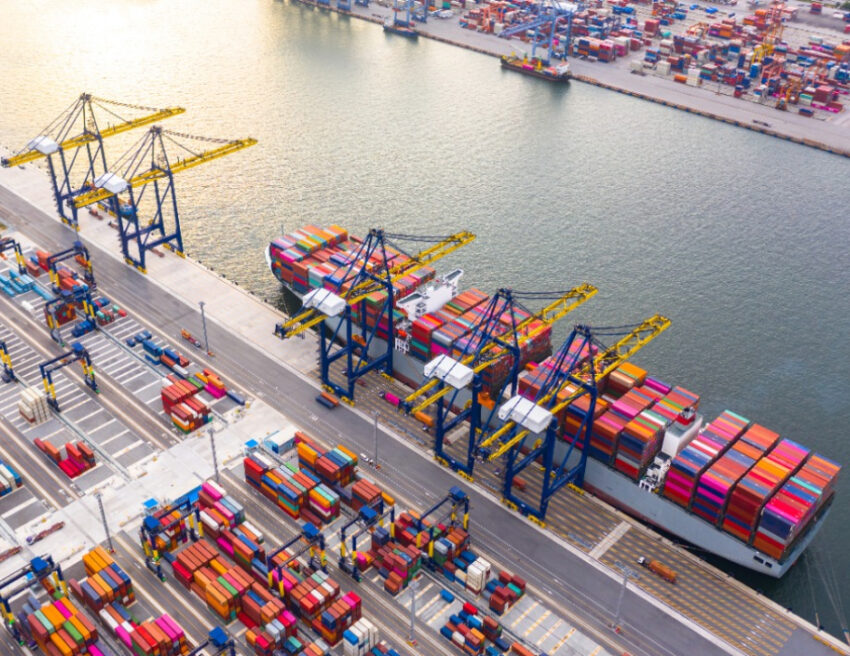

After more than one month of logjams and disruptions because of a renewed outbreak of Coronavirus, in and around Shenzhen, the Yantian International Container Terminal is finally ready to resume regular operations. This major port in South China has restarted full operation since 24 June. However, they are observing all measures to control the pandemic and social distancing is in place in the port areas. In today’s post we are going to discuss the problems of the Yantian port congestion, its effects on the ocean shipping industry and how the port is gearing up to reopen.

The Yantian Port Congestion and its impact on the ocean shipping industry

The port authority was busy containing the spread of Covid ever since a few port workers got infected in the last week of March. Since then the Yantian Port was operating at 30% of its capacity. Presently, the port is working at 70% capacity and very soon all operations are going to resume. According to Florian Braun, the Head of Oceans at Flexport, there is still a large backlog because of the drop in capacity in the last few weeks. However, the safeguards tremendously reduced the output at Yantian. This port alone handled over 13 million TEUs last year.

Reefer surcharge

Because of the congestion the dwell loading times went up as much as 122% last month. On the other hand, the departure times increased 242%. According to a report by CNBC, around 300,000 TEUs of cargo were piled up in the dock waiting to be moved. This caused a severe shortage of reefer plugs. For this reason, CMA CGM along with other carriers have introduced a reefer surcharge. Because of the unavailability of free reefer plugs, CMA CGM charged as much as $1,250 for each reefer container.

Important shipping companies were avoiding this port

Some of the most important names in ocean shipping industry such as Mediterranean Shipping Co and Maersk were avoiding the Yantian Port because of the congestion problem. The increased safety measures, and constant checks hampered the efficiency in the port. Additionally, this resulted in bottlenecks at other Chinese ports in the Pearl River deltas. It also strained the supply chain that was already trying to recover from the effects of the Covid-19 and the Suez Canal blockage. Hapag-Lloyd reported that the congestion at Shenzhen Port resulted in over twelve blank sailings.

The congestion will have long term effects

The numerous blank sailings implies that the export shipments will lag behind and the backlogs might take months to recover. Some are even expecting the effects of the congestion to last till the Christmas holiday season. Mirko Woitzik, from Evergreen Analytics, believes that the cancellation of port calls to Shenzhen by major carriers would continue to last even a few weeks after the port reopens. The holiday shipping will commence in August. By this time most manufacturers will start moving their products to hit the shelves in time for Christmas. Therefore, the congestion will lead to long queues of waiting containers even after the port starts operating.

Shipping costs have reached a record high

The disruptions in the 4th busiest container ports of the world have also adversely affected the shipping price. To begin with, the spot rates for 40-foot boxes to Los Angeles from Shanghai have increased by 11%. Similarly, the shipping cost of freight from Shanghai to Rotterdam has also increased by 10%.

Electronic consumer goods are one category that’ll suffer maximum delay

The delays in sailings will most impact the movement of electronic consumer goods. This category includes domestic appliances, electronic items, machinery, and medical equipment. In the words of Mr, Woitzik, “Walmart and Home Depot can be impacted and see shortages because they have logistics bases around that port. Basically, the shipping lines are taking the highest-bidding shippers. Usually, those bidders are the high-value electronic consumer goods.”

In other words, even if they can provide all the required 40 feet containers, they’d need to export around 160,000 containers. Moving this sheer volume of containers will take considerable time even after the port starts functioning normally. More than 90% of the global electronic items are shipped from the Shenzhen Port and some of the main exports include top brands like Ikea, Walgreens, Tesla, Amazon, Home Depot, Walmart, etc.

The Yantian Port resumes operation

Since last week the Yantian Port has resumed full operation. The pandemic has effectively been brought under control and the operation capacity is present back to normal. According to an official announcement on the official website of the Yantian Port, “The number of laden gate-in tractors will be increased to 9,000 per day, and the pickup of empty containers and import laden containers remain normal…Yantian will continue to strictly implement epidemic prevention, control measures and promote production in a safe and orderly manner.”

Nevertheless, Maersk has warned its clients that the reliability of the schedule still remains compromised. They reported that the congestion impacted 19 of its routes. At present 11 out of the 20 container berths have been floated and daily throughput has reached 270,000 TEUs. Most importantly, the reopening of this port will reduce the pressure on the nearby docks that were having to deal with the increased pressure of shipment flow.

Furthermore, the port authority has stated that all berths will be functioning normally and that they will increase the number of laden gate-in tractors to 9,000 per day. Additionally, the pick-up of empty containers and loaded import containers will be back to normal. The port operators have refused to provide an estimate of the number of backlogged boxes. Industry experts are predicting several thousand TEUs of shipment stuck at their yard. For this reason, the backlog of stranded boxes in the port’s yard might take several weeks to clear. Moreover, the arrival of additional shipments on its way to Europe and the US will add to the delay.